nj ev tax credit phase 2

Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives. New Jersey residents will now get up to 5000 off the purchase of an electric vehicle the most aggressive state EV incentive in the nation.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

NJBPU anticipates Phase Two will begin in summer 2021 and provide incentives at the time of purchase.

. Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the sticker price of. 10 discount on the off-peak rate for the New Jersey Turnpike and Garden State Parkway. The Point-of-Sale Incentive Terms Conditions.

When Phase 2 of the Program is launched dealerships will be able to apply the. 2 days agoAs a result of the phase-out buyers of the soon-to-be launched all-electric 2023 bZ4x which starts at 42000 will find that they might not. The Biden administration and carmakers are betting big on electric vehicles.

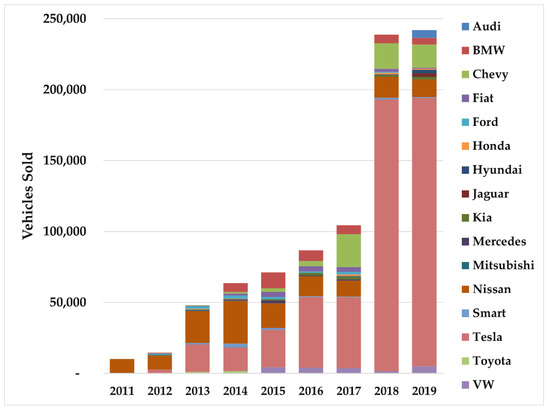

I think I read on this forum it will be summer 2021 if Im not mistakenm It seems like sales tax is still exempt for EV but any idea if the 5000 rebate will happen again. Governor Phil Murphy has set a goal of registering 330000 EVs in New Jersey by 2025 which will reduce emissions from the transportation sector and help reach the goals of New Jerseys Energy Master Plan and the Global Warming Response Act. Battery Range miles Battery Size kWh Motor kW Base MSRP Federal Tax Credit.

I spent a week driving around New Jersey in two EVs to gauge how prepared the state is for them. In order to qualify for the Charge Up New Jersey incentive residents must have purchased or leased an eligible EV between Jan. The Charge Up New Jersey Program offers an electric vehicle EV incentive of up to 5000 to New Jersey residents who purchase or lease a new EV from a New Jersey dealership or showroom.

New Jerseys EV incentive program has been very successful. Applicants may only receive up to four vehicle incentives from the Charge Up New Jersey program throughout the ten-year period the program is active. 5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model.

But when combined with the federal tax credit of up to 7500 EV drivers in the Garden State can get as much as 12500 off. The intent of the Charge Up New Jersey program is to encourage the purchase or lease of new light-duty plug-in electric vehicles in the State and assist New Jersey residents. There is clearly enthusiasm for electric vehicles so while the program is paused we are evaluating all options with the hope of reopening before the next fiscal year said BPU President Joseph Fiordaliso.

New Jersey is leading the way on electric vehicle EV adoption on the East Coast. The New Jersey Board of Public Utilities unveiled the online application for Phase 1 of the Charge Up New Jersey EV rebate program. In addition the federal Qualified Plug-In Electric Drive Motor Vehicle Credit an IRS tax credit for 2500 to 7500 per vehicle is set to phase out after certain sales benchmarks are reached.

Charge Up New Jersey Terms and Conditions 1. Phase 1 of the Program requires consumers to apply for the incentive online after the eligible vehicle purchase or lease has been completed. Dealers will have the option of offering the rebate as part of a lower price on a new electric vehicle.

Due to such successful uptake Year Two of. New Jersey Sales Use Tax is waived for any battery electric vehicle BEV purchased or leased in the State of New Jersey. Charge Up New Jersey.

Any idea on what Phase 2 in NJ will look like. Charge Up New Jersey Terms and Conditions 2. FY22 Charge Up New Jersey Compliance Filing3Acknowledge that the entirety of the purchase or lease for an eligible vehicle must occur on or after the official launch of Phase Two the Point-of -Sale Program and in the State of New Jersey at a.

Mar 21 2021. The NJBPU anticipates Phase Two will begin in summer 2021 and provide incentives at the time of purchase. New Jersey had about 40000 EVs on the road as of last June.

Announced by Governor Murphy in January Phase One of the program started issuing incentives in May and provides post-purchase incentives for eligible EVs. Relaxed area for all around discussion on Tesla this is the official Lounge. 15 2020 in the State of New Jersey and submitted an application for consideration by March 15 2021.

New Jersey just restarted its electric vehicle incentive program. To apply call New Jersey E-ZPass at 1-888-AUTOTOLL 1-888-288-6865. NJ Tax Credit - Summer 2021.

Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the sticker price of. New Jersey currently has a sales-tax exemption for. Sales Tax Exemption - Zero Emission Vehicle ZEV Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA.

Greetings all I am in NJ and waiting for Phase 2 of the Charge-Up New Jersey rebate program to begin. Electric vehicles are qualified to receive reduced toll rates via the Green Pass Discount through their EZ Pass accounts. Trenton NJ The New Jersey Board of Public Utilities NJBPU today announced Year Two of the popular Charge Up New Jersey Program its electric vehicle EV incentive initiative is expected to expend all funds ahead of schedule moving New Jersey closer to Governor Murphys goal of 330000 EVs by 2025.

Customers must enroll in the plan and provide proof of eligibility.

Latest On Tesla Ev Tax Credit March 2022

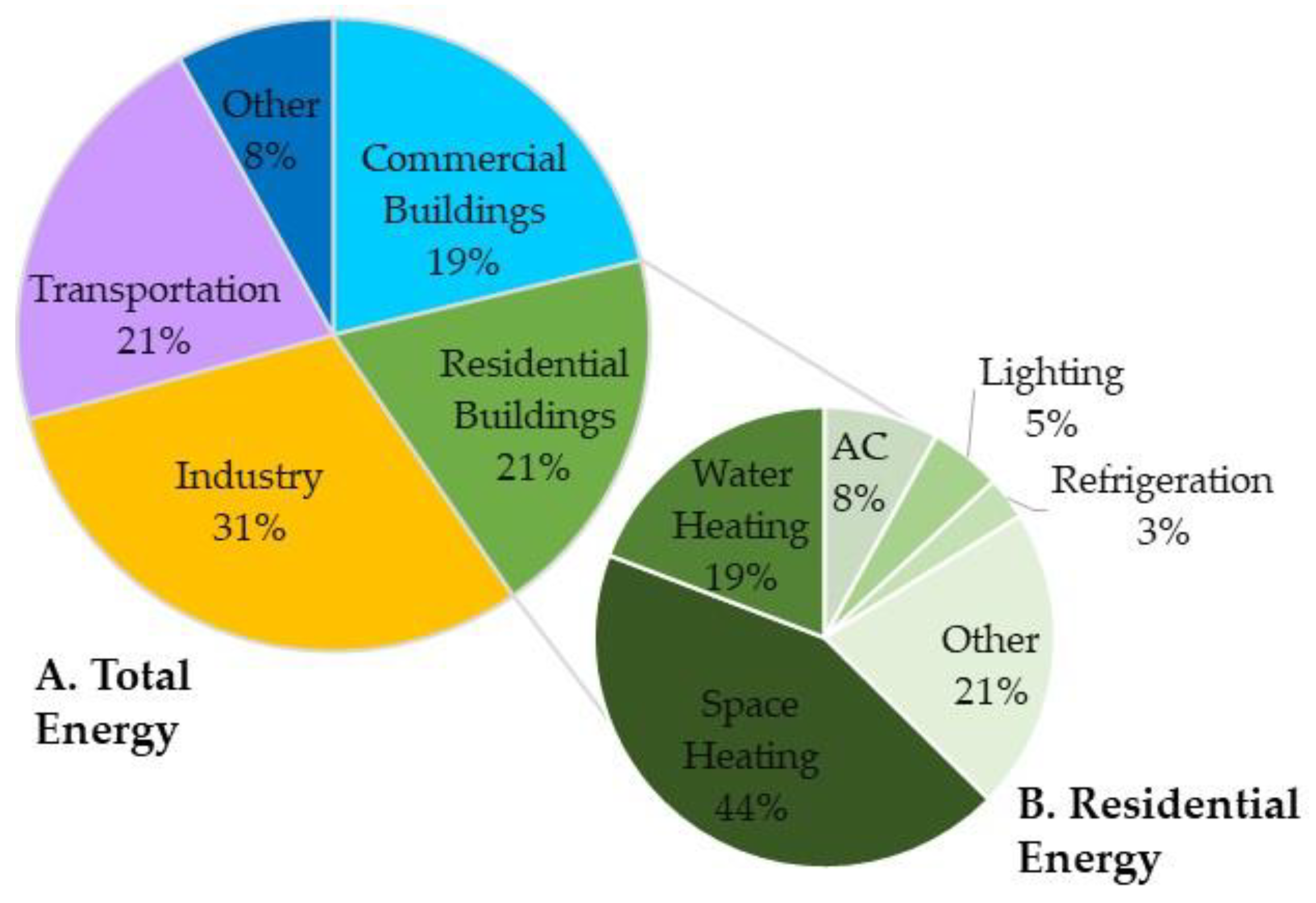

Energies Free Full Text Review Of Adoption Status Of Sustainable Energy Technologies In The Us Residential Building Sector Html

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Latest On Tesla Ev Tax Credit March 2022

Energies Free Full Text Review Of Adoption Status Of Sustainable Energy Technologies In The Us Residential Building Sector Html

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

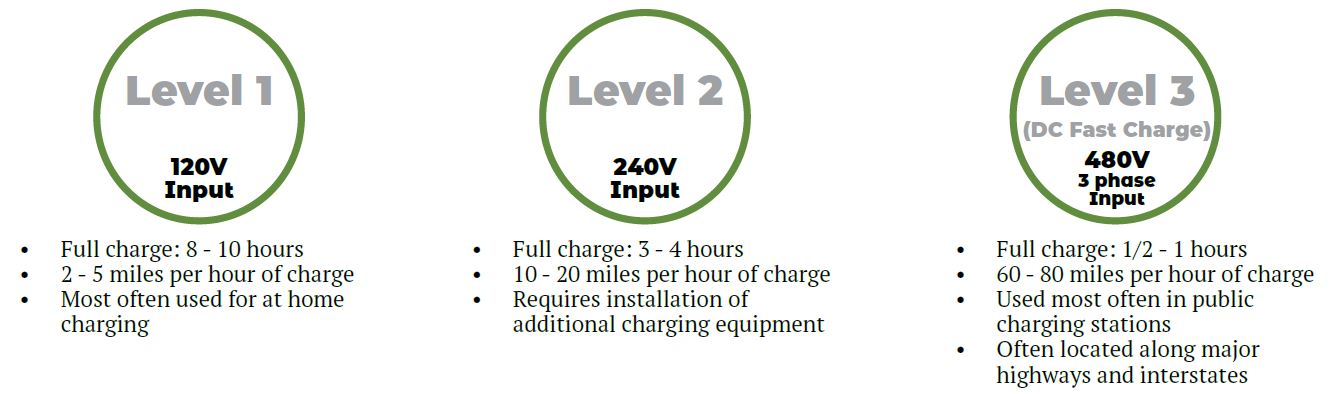

Indiana Municipal Power Agency Electric Vehicles

The Surge Of Electric Vehicles In United States Cities International Council On Clean Transportation